Yeske Buie Weekend Digest 10/30/2009

With the stock market serving up a little pre-Halloween scare, it seemed like a good time to offer up another edition of the Weekend Digest. From Jeremy Siegel’s defense of “market efficiency” to a discussion of how the demographics of the X and Y generations are going to rescue the portfolios of their Boomer parents, we hope you find something of interest below.

Happy Halloween!

Media Matters

Tough Questions Clients Ask.

Ron Lieber of the New York Times moderated a panel devoted to the “hardest questions that clients ask” at the Financial Planning Association’s recent annual conference in Anaheim. Elissa participated in the panel and was quoted extensively in Lieber’s subsequent write up in the Times.

New Members of the Team!

The Yeske Buie financial planning team has just been expanded by two recent graduates of the financial planning program at Virginia Tech University. In addition to their work as assistant financial planners, Jennifer and Yusuf will be doing Client Service work with Summar’s oversight.

Jennifer Micieli

Jennifer earned a B.S. in Agricultural and Applied Economics with an option in Financial Planning, as well as a minor in Business from the Pamplin College of Business at Virginia Tech. In her free time, Jennifer enjoys writing, reading classics, cooking, dancing, playing tennis, visiting new places, watching Hokie football, and spending time with friends and family.

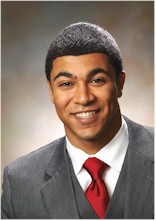

Yusuf Abugideiri

Yusuf Abugideiri

Yusuf earned a B.S. in Finance in the financial planning track in Virginia Tech’s Pamplin College of Business. Yusuf was an ambassador for the business school and Student Director of Hokie Camp 2009, an orientation and team-building program for incoming freshmen. In his free time, Yusuf enjoys watching football, working out, reading, cooking and eating great food, and spending time with friends and family.

Note on pronunciation

It wasn’t our intent to hire two new employees with last names that could be pronounced a hundred different ways, but here is how their last names are correctly pronounced:

Mi Shell’ Eee

Uh Boo’ Ji Dairy

How to Get Help

And don’t forget that our updated client page (https://clients.yebu.com/) offers a full list of who does what and who you should contact for help with various issues. Contact numbers and email links are available from that page as well.

Academic Hypothesis Not Guilty!

Jeremy Siegel, writing in the Wall Street Journal on Tuesday, defends the Efficient Market Hypothesis (EMH), which many have declared defunct after the meltdown of the past year. Siegel points out, however, that the EMH never claimed that market prices are always right — to the contrary, it implies that prices are mostly wrong — it simply says that there’s no way to know HOW they’re wrong. That is, there’s no way to know whether they’re too high or too low, and thus, our best strategy is to accept the market price as our best estimate of true value.

He further points out that “neither the rating agencies’ mistakes nor the overleveraging by financial firms in subprime securities is the fault of the Efficient Market Hypothesis. The fact that the yields on these mortgages were high despite their investment-grade rating indicated that the market was rightly suspicious of the quality of the securities, and this should have served as a warning to prospective buyers.”

In addition to being a professor of finance at the University of Pennsylvania’s Wharton School, Siegel is also one of the founders of Wisdom Tree, the company that manages the international mid-cap fund in your portfolio. Also worth noting is that the originator of the Efficient Market Hypothesis, Eugene Fama of the University of Chicago, is a board member and Director of Research for Dimensional Fund Advisors (DFA).

Staying Calm in a World of Dark Pools, Dark Doings

Jason Zweig lays out the case for why dark pools and high-frequency traders are our friends. While the sometimes frantic trading of these “professional” players is just noise to the long-term investor, they also serve a valuable function by creating liquidity and lowering transaction costs for everyone.

As Zweig puts it, “As an investor, you are free to choose your own time horizon. If other people want to try to earn a few fractions of a penny, a few thousand times a day, you should wish them well — and refuse to join them.”

Use Demographics to Front-Run Your Children

The Business Insider reports on a little nugget that Tobias Levkovich included in a recent Citi presentation, in which he makes the case that demographic trends will tend to drive the markets higher for the foreseeable future. Levkovich points out that the number of people entering the prime savings years of 35 – 39 is expected to increase well into the future. While there will be a brief dip in the near term, Levkovich suggests that this is really a buying opportunity for Boomers.

I’m not a fan of demographic explanations for market trends (and the economic evidence for such is weak) but this should at least give pause to anyone claiming that the looming retirement of the Baby Boomers bodes ill for the market.