TheLiveBigWay* – It’s like deja vu all over again

The Eurozone is back in the news today as economic and political events have given rise to fresh doubts that European policy-makers will get their financial house in order. Renewed uncertainty took several forms, from comments by the head of the IMF that Europe is at the heart of the economic cloud that still hangs over the world economy, to a fresh batch of economic reports showing shrinking private sector activity not just in Spain, one of the so-called “peripheral” countries, but also in Germany, the industrial heart of the EU. The resignation of the Dutch government over its inability to pass an austerity budget and the strong showing by Francois Hollande in France’s first round of presidential voting also added to the air of pessimism. Hollande is opposed to the tough budget stance adopted by the EU earlier this year and has vowed to renegotiate.

In commentary broadcast yesterday, CNN economist Fareed Zakaria notes that the austerity strategy adopted by the Europeans – primarily at the insistence of Germany – is quite the opposite of the approach adopted in the U.S., and with dramatically different results.

The U.S. economy, which received monetary and fiscal stimulus, will grow at well over 2% this year. European economies that have followed the path of cutting spending and raising taxes to reduce deficits are finding themselves in a downward spiral: cutting spending means laying off people, which means less demand for goods and services, which means the economy shrinks, which – ironically – means lower tax revenues and thus larger budget deficits.

Take a look at Britain. Britain has followed a brave austerity plan, cutting government spending across the board and raising taxes. The result, British growth has stalled; the economy will grow barely 0.8% this year. And while its budget deficit was predicted to be under 13 billion dollars in February, it was in fact 24 billion dollars for that month alone.

This has been our own position throughout the policy debates both here and abroad. There’s no question that both the U.S. and Europe need to get government spending under control over the long run, but cutting too soon only makes the debt problem worse and, perversely, exacerbates the very problem it was meant to solve. You can watch Zakaria’s full comments below.

One immediate consequence of renewed Euro-pessimism has been a decline in stock prices on both sides of the Atlantic, with the sharpest declines seen in European shares. As always, we think there are two ways to think about this:

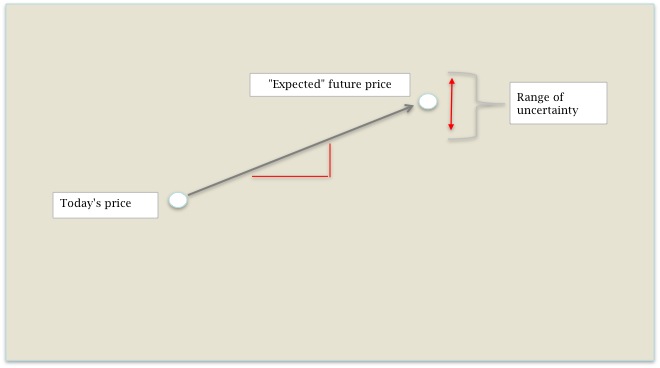

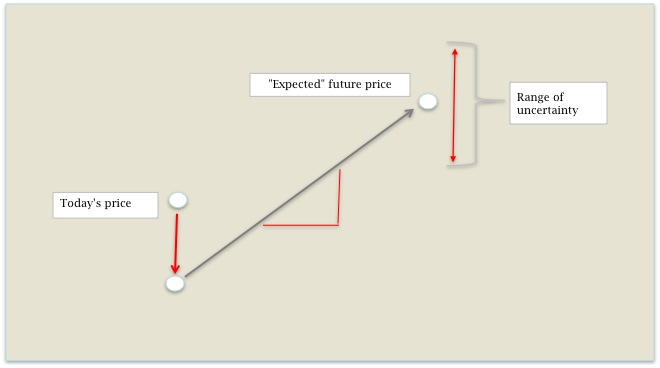

First, European shares have already been “priced” for higher returns and the latest drop is simply the continuation of that process. It’s very easy to look at current and prospective economic conditions in the Eurozone and think that European markets are going to be a bad investment for the foreseeable future. However, this isn’t how markets work. The declines we saw last year, combined with those seen in more recent days, serve to price shares for the higher returns that should correspond with worsening economic prospects. The following illustration shows how this market mechanism works. As you can see, when markets push prices down in response to new information (including increased uncertainty, as in the example below), it is for the purpose of establishing a new, higher (steeper), expected return path.

All other things being equal, a lower price translates into a higher expected return, with forecasts of poor economic performance “priced in.” While it’s true that an individual company might have its price pushed all the way to zero when it goes out of business (like Enron, for example), stock markets generally do a good job in the aggregate. Which means that it’s very important to be extremely well diversified at all times, minimizing the risks of any individual company or industry and maximizing your chances of capturing the market’s inherent “goodness.” As further evidence that poor economic performance gets “priced into” the markets, note the table below. Investors around the world are risk-averse and price securities to provide an appropriate risk-adjusted return whatever’s happening in the economy as a whole.

| Developed Markets (1971-2008) | Avg. Return | Std Deviation | Avg. GDP Gwth |

| High-Growth Countries | 12.90 | 23.07 | 0.92 |

| Low-Growth Countries | 13.52 | 23.04 | -4.02 |

Second, we suggest that it is important to keep the scale of recent events in perspective. In the context of the strong positive trend that we’ve seen over the past six months, recent reversals are quite modest and loom large only because of the sometimes overblown economic doomsaying. This can be seen in the chart below, showing the advance of the MSCI All Country World Index over the past three years through this past Friday, with April’s hiccup encompassed in the small circle on the right.

While we agree with Zakaria that European policymakers should have focused more on stimulus first and austerity later, we still believe that they’ll provide sufficient support, especially for the fragile banking sector, to avert economic calamity.

As in all times, politicians will generally do the right thing in the end, though often not before exhausting every other possibility!

The Yeske Buie Team

*Service Marked (SM)