Social Security: Nixing the Knowledge Gap

It is estimated that Social Security has 2,728 different rules1 and that there are more than 8,000 claiming strategies for married couples alone2. As these staggering numbers suggest, Social Security is a complicated topic. As a result, there is often a knowledge gap for hopeful retirees which may have a bigger impact than they would believe to be true. Last week, AARP and the Financial Planning Association (FPA) released the results of a survey conducted to discover what pre-retirees do and don’t know about Social Security. Some of the most striking gaps, according to the survey, include not knowing the earliest retirement age or not knowing how much they would receive in additional benefits by waiting until the Full Retirement Age (or that they would receive any additional benefit at all!).

It is estimated that Social Security has 2,728 different rules1 and that there are more than 8,000 claiming strategies for married couples alone2. As these staggering numbers suggest, Social Security is a complicated topic. As a result, there is often a knowledge gap for hopeful retirees which may have a bigger impact than they would believe to be true. Last week, AARP and the Financial Planning Association (FPA) released the results of a survey conducted to discover what pre-retirees do and don’t know about Social Security. Some of the most striking gaps, according to the survey, include not knowing the earliest retirement age or not knowing how much they would receive in additional benefits by waiting until the Full Retirement Age (or that they would receive any additional benefit at all!).

With the results of the survey being a hot topic among the financial planning profession, Dave sat on a panel at FPA’s Annual Conference in Boston last week to discuss the topic. The other panelists included Gary Koenig, AARP’s Vice President, Economic and Consumer Security, and Thomas L. Hungerford, Ph.D. – Associate Commissioner, Office of Retirement Policy at the Social Security Administration. The panel discussed questions such as,

- What role does Social Security play in pre-reitree/retiree retirement planning?

- Do consumers know important claiming strategies and are they taking advantage of them?

- How are planners helping their clients address Social Security in retirement?

With 25 years of experience in helping Clients with their financial needs, Dave noted to CNBC reporter Shelly Schwartz that, “The average consumer seems to assume Social Security will represent a much larger proportion of their income in retirement than financial planners would estimate, which means they may have less incentive to aggressively save on their own, either through employer-sponsored retirement plans or independently.” Furthermore, Dave spoke with Richard Eisenberg, contributor for Forbes Personal Finance, and said, “Their [consumers] understanding of Social Security is pretty good, but there was a huge lack of knowledge about the impact of deferring benefits and about spousal benefits.” But why is this knowledge gap so significant? Dave explains that “The choices people make about collecting Social Security retirement benefits could have a huge impact on the benefits they receive over the next 30 or 40 years.”

|

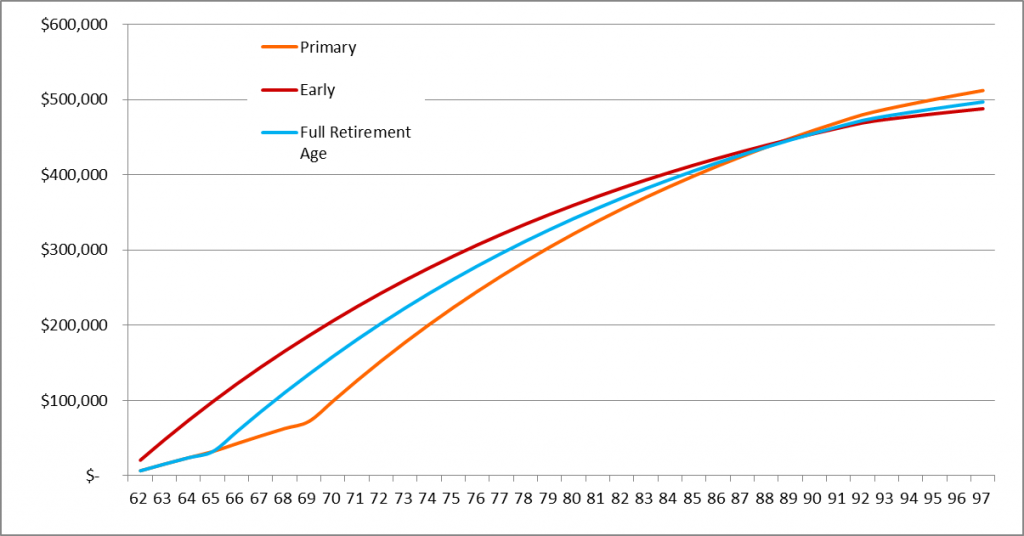

TYPE

If you consider yourself to be one of the many consumers confused by Social Security, don’t be too hard on yourself. The three panelists acknowledged that making the right decision regarding Social Security can be difficult. Dave agreed with the panelists noting “that financial planners even use Social Security software”. So what can you do to ensure you are maximizing your Social Security benefits? Many agree that enlisting the help of a CFP® professional will lead to better decisions and more secure finances in retirement. At Yeske Buie, we assist our Clients in making the best decision by preparing an analysis based on the individual’s benefit amounts, age, and specific needs. When a Client is nearing age 60, Yeske Buie requests current copies of a Client’s Social Security Statement to begin our evaluation of a Client’s potential claiming strategies. Our preferred software, Social Security Analyzer, will create a graph – similar to the image below – based on the specific Client information inputted into the system. With this graph, we will recommend a claiming strategy and have a discussion with the Client. By preparing this analysis at around age 60, we allow the Client to consider their options for some time before committing to a decision.

|

TYPE

In the end, choosing the right Social Security strategy is equally complicated as it is important. Whether you chose to gain more knowledge on the topic yourself or ask a financial planner for help, Dave offers one generic guideline to ensure you make the right decision: “Don’t wait until you’re about to file for benefits”.

SOURCES:

- Huffington Post: Top 10 Things You Must Know About Social Security’s 2,728 Rules1

- Forbes: What You Don’t Know About Social Security Can Hurt You2

- CNBC: Many Americans Lack Social Security Smarts: Study

- Financial Advisor: Are Americans Clueless About Social Security?

- AARP Research: Consumer Knowledge About Social Security Claiming Decisions and the Role of Certified Financial Planners

- Social Security Simply Stated