The Brexit Bust

When we wrote last Friday morning in the immediate aftermath of Thursday’s Brexit, global markets were in freefall and anxiety was rising. We acknowledged the potential negative impact on the UK economy and the probability of heightened volatility in the near term. We then noted:

Europe, the U.K., the U.S. and the rest of the world will adapt to the new reality. As for the markets, they discount the future and will absorb and reflect the implications of Brexit relatively quickly. So best not to extrapolate what happens today or next week very far into the future.

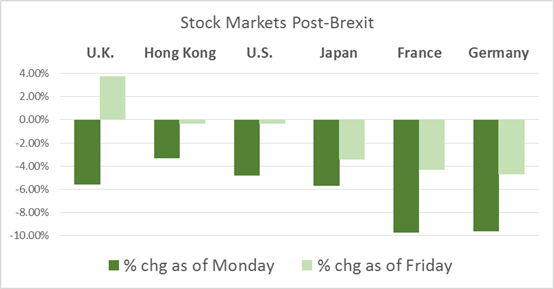

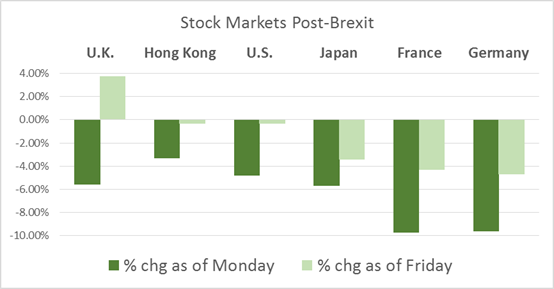

What a difference a week makes! As we write this note a mere week later, the US market has recovered to pre-Brexit levels and the UK markets are actually higher than they were prior to the vote. Emerging markets and global real estate securities have also fully recovered. Germany and France, meanwhile, have undone more than half of the declines of Friday and Monday, their markets rising during each of the last four trading sessions.

It’s interesting to note how quickly the world has digested the news and, seemingly, moved on. And many of those in the UK who spoke most ardently in favor of the Leave campaign seem to be walking back some of their prior (extravagant) claims and new paths seem to be opening up for possibly unmaking the decision.

Whatever happens, we’ll continue to watch with interest.