Short take: do the markets fear Trump?

Display of Stock market quotes

A few days after the first presidential debate, University of Michigan economist Justin Wolfers published a piece in the New York Times titled, Debate Night Message: The Markets are Afraid of Donald Trump. In it, he predicted that stock markets would fall 10% – 12% if Donald Trump is elected. He based this on an analysis of movements in the futures markets during the first presidential debate, during which stock market futures rose, seemingly in response to “prediction markets” lowering Trump’s probability of being elected. Nate Silver’s FiveThirtyEight website was giving Hillary Clinton a 55% chance of winning against a 45% chance for Donald Trump on the day of the debate, odds that have since shifted to 76%/24% in favor of Clinton. Nonetheless, trepidation is running high and we’ve received a lot of calls and emails from clients asking, “what if . . .”

Attempts to predict what impact a presidential election will have on the markets has a long history . . . and little value. For starters, there have only been 29 such elections since the beginning of the 20th century, a sample most statisticians would consider too small for robust inferences. Secondly, what little data exists is noisy, with only weak correlations to go by. Having said that, as a thought experiment, let’s take it as a given that a Trump victory would have an impact on the market, if for no other reason than it would be such a big surprise given current predictions. We know markets don’t like surprises. What recent parallels might we look to for guidance?

Brexit, of course.

In the weeks leading up to the June 23 Brexit vote in the UK, prediction markets and pollsters were giving the “stay” vote a narrow margin of victory. And since most economists and investors had concluded that a vote to stay would be good for the UK, the EU, and the world at large, markets around the world rose in the days leading up to that fateful vote. Then came the Friday morning hangover as the British voted to part ways with the European Union.

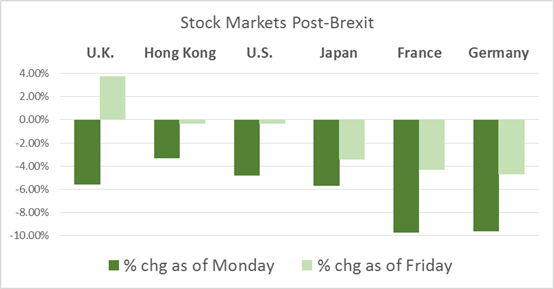

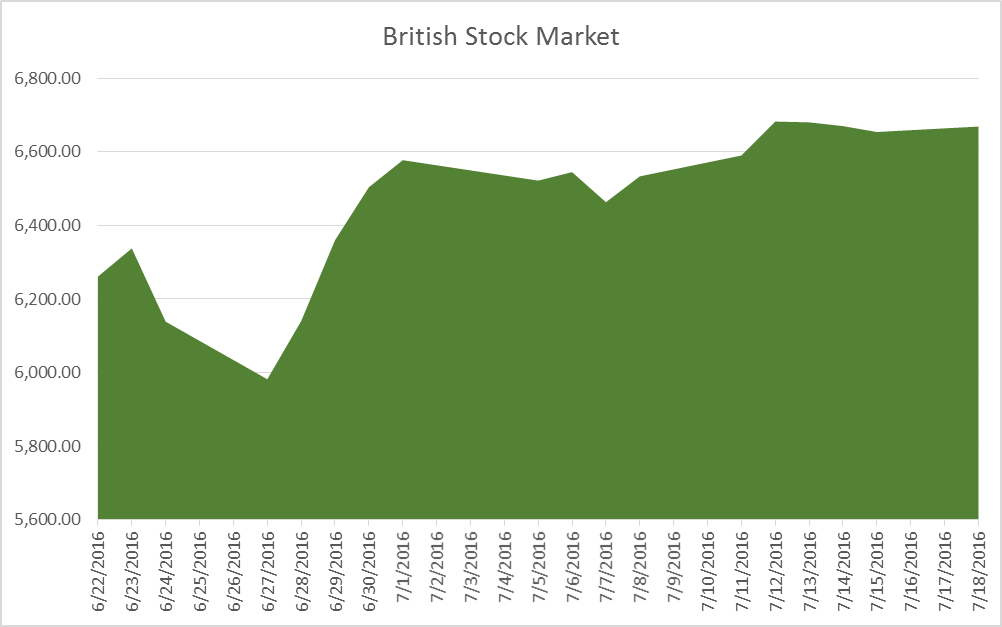

Between Thursday and Monday, world markets fell by more than 7%, while the British stock market fell by nearly 6%. However, as apocalyptic as the initial headlines may have been, investors quickly shrugged it off, as can easily be seen in the charts below, and the British market regained its pre-Brexit highs within a single week. The rest of the world took three weeks to do the same thing, by which time the British market was nearly 6% higher than its pre-Brexit highs. Both the British and world markets are even higher today.

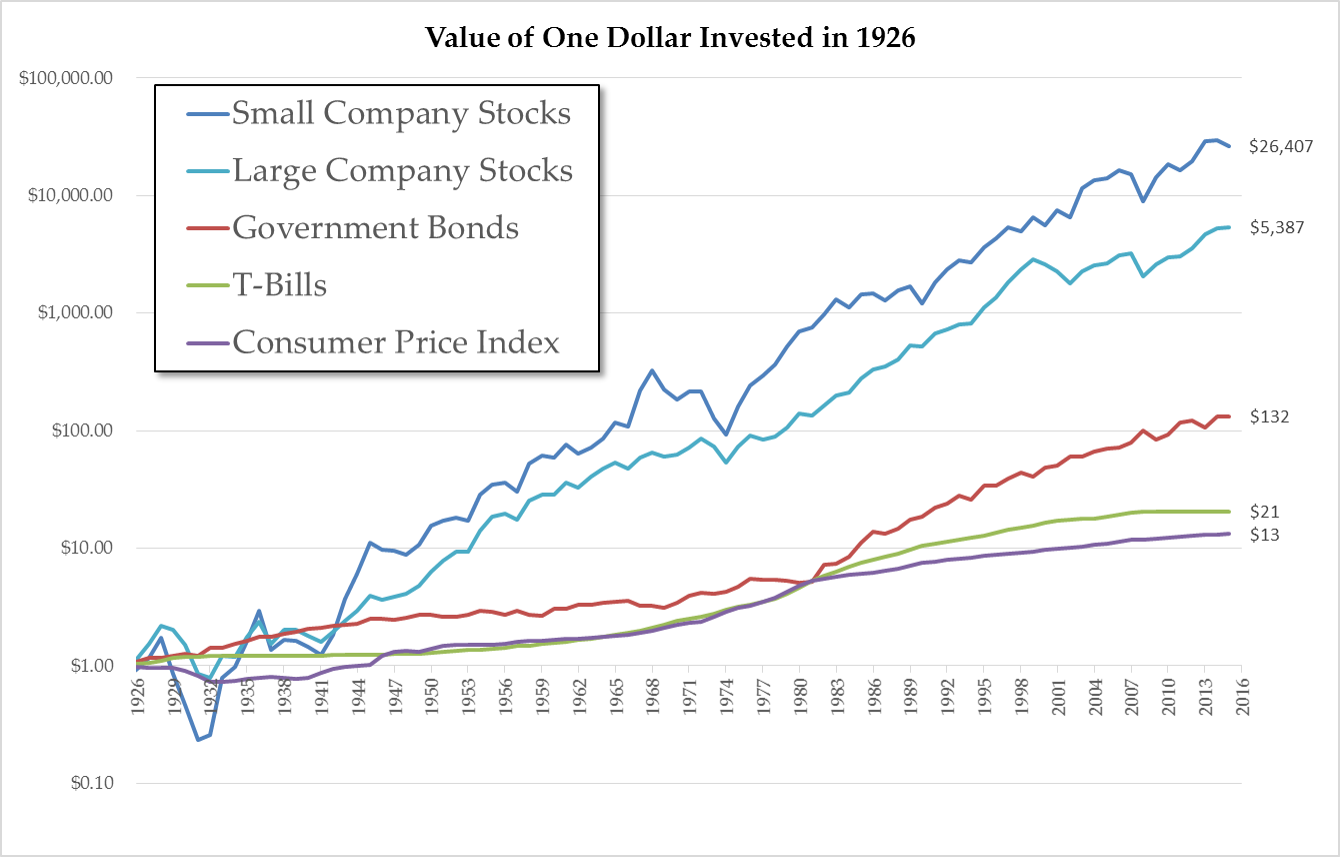

The final thing we’d like to note is this: human beings and the economies and markets they build are resilient things. If you look at the past century of U.S. history you will see that the economy tended toward growth and the markets tended to rise during Republican and Democratic administrations alike, good and bad, competent and incompetent. The wealth chart below shows how $1 invested in various assets at the end of 1926 has fared over the intervening nine decades.

If Professor Wolfers’ “event analysis” is correct, markets aren’t going to like it if

Donald Trump is elected president. But they’ll get over it.