Investment Update – Going Short (Really Short!)

No, we haven’t decided to short the stock market — not by a long-shot! — but we have decided to shorten the average maturity of our bond holdings. We’re doing this by swapping all of the DFA 5-Year Global Bond portfolio (DFGBX) into the DFA One-Year Fixed Income portfolio (DFIHX).

The reason for this change was our desire to further reduce the “interest rate risk” in our portfolios. As we discussed earlier this year in “Managing Risk When Rebalancing Into Bonds,” there are three ways to control risk: diversify, keep credit quality high, and keep the average maturity of our bond portfolio short. We’ve chosen to work by means of that last factor by shortening the average maturity of our bond holdings, which are already diversified and high credit quality.

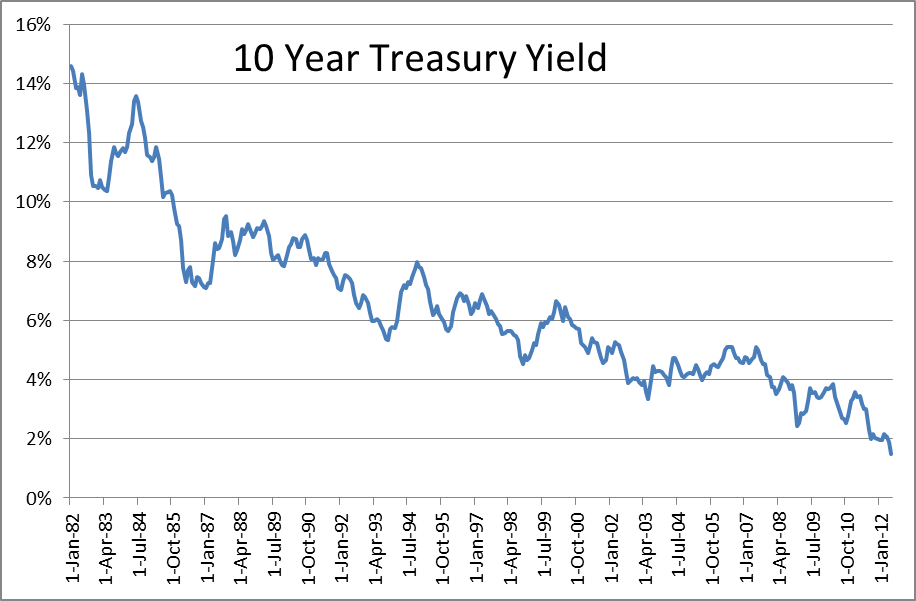

Bond prices are sensitive to changes in interest rates, rising when rates fall and falling when rates rise. With interest rates currently so low (see chart below), we feel that the risk of a future rise in rates is great enough to justify taking a more conservative stance. It’s possible that rates will stay low for some time to come but we don’t feel the potential for additional interest income is great enough to justify the additional risk.

There is a measure of a bond portfolio’s sensitivity to changes in interest rates called “duration” that we can use to assess any given portfolio. In the case of the DFA 5-Year Global Bond portfolio, its duration is 3.95. This means that a 1% rise in interest rates – all other things being equal – would cause a 3.95% fall in the value of the fund’s portfolio. While it is true that the price drop of the portfolio’s individual bonds would eventually disappear as they approached maturity and were redeemed at “par,” this would take several years and would not be realized for any shares that were sold in the intervening time. We believe that bonds should be used as a “stable reserve,” making even short-term price declines unacceptable (especially for anyone who is actually spending from their portfolio).