Short Take – Emerging Market Blues

Emerging markets (EM) have been in the news lately, in part because stock markets in those countries have been falling in recent months (for reasons we’ll discuss further) but also because of crises and disruptions occurring in a handful of specific countries. The New York Times recently published an article which specifically profiled the troubles in Argentina, Turkey, South Africa, and Russia, prompting us to share our thoughts on the topic.

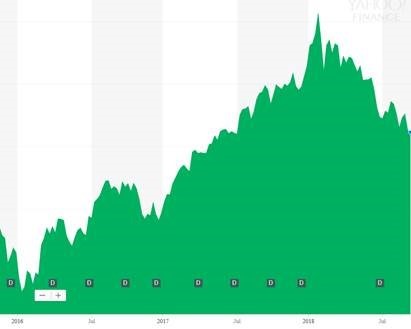

Our preferred vehicle for gaining Emerging Market exposure is the DFA Emerging Markets Core Equity portfolio (DFCEX), which, while down 1.4% for the 12 months just ended, has done well for long-term investors and has had a particularly nice run over the past two and a half years (see chart below).

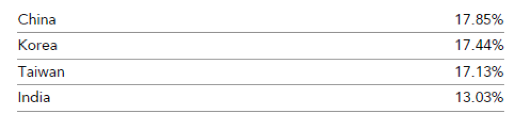

Relative to the bad news detailed in the New York Times article, nearly 70% of the DFA Emerging Markets Core Equity fund is invested in China, Korea, Taiwan, and India (see below) and none of it in Venezuela or Russia (two of the troubled countries profiled in the article).

One of the things that has depressed emerging market returns lately, along with those of other non-US markets, has been the recent rise in the dollar. However, and notwithstanding the fact that rising US interest rates, all other things being equal, tend to strengthen the dollar, it’s path is ultimately unpredictable. As you can see in the chart below (2016 to present), the dollar rises and falls relative to other currencies, having boosted EM returns in 2016 and 2017 and taken some of it back this year. In the long run, we believe the dollar-driven fluctuations tend to cancel out, leaving the underlying economic fundamentals as the main drivers of performance.

We’re currently maintaining an average allocation to emerging markets of about 7%, which we believe an appropriate exposure to this important component of the global stock market.

As always, please don’t hesitate to give us a call or drop us a note if you have questions about any aspect of your portfolio (or anything else, for that matter!).