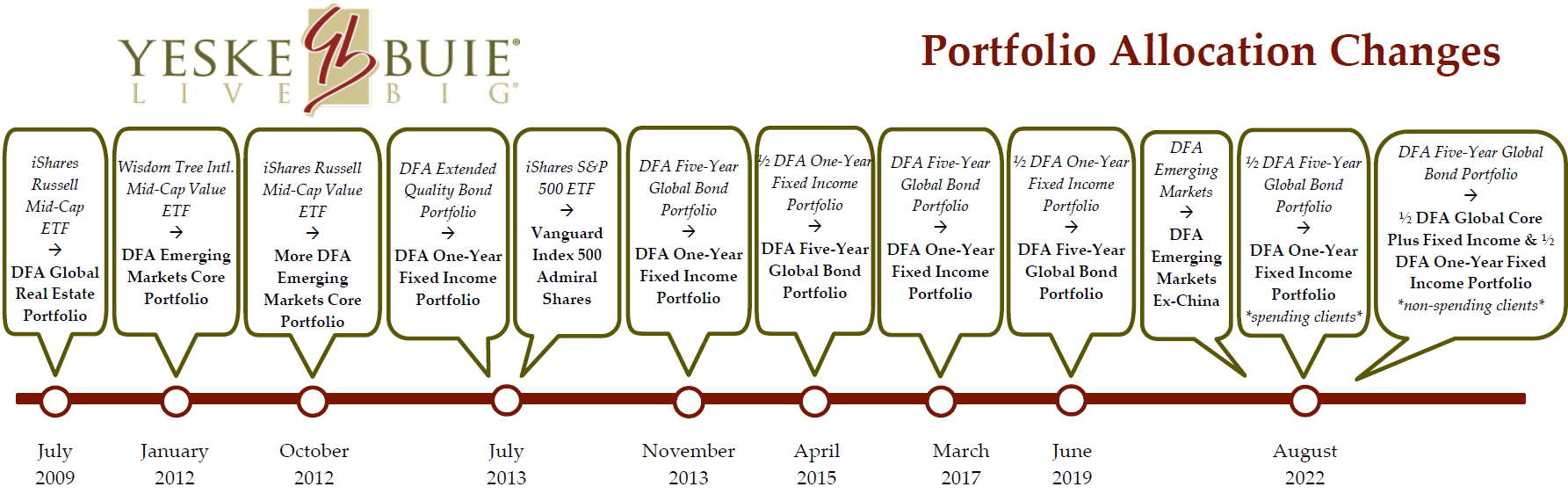

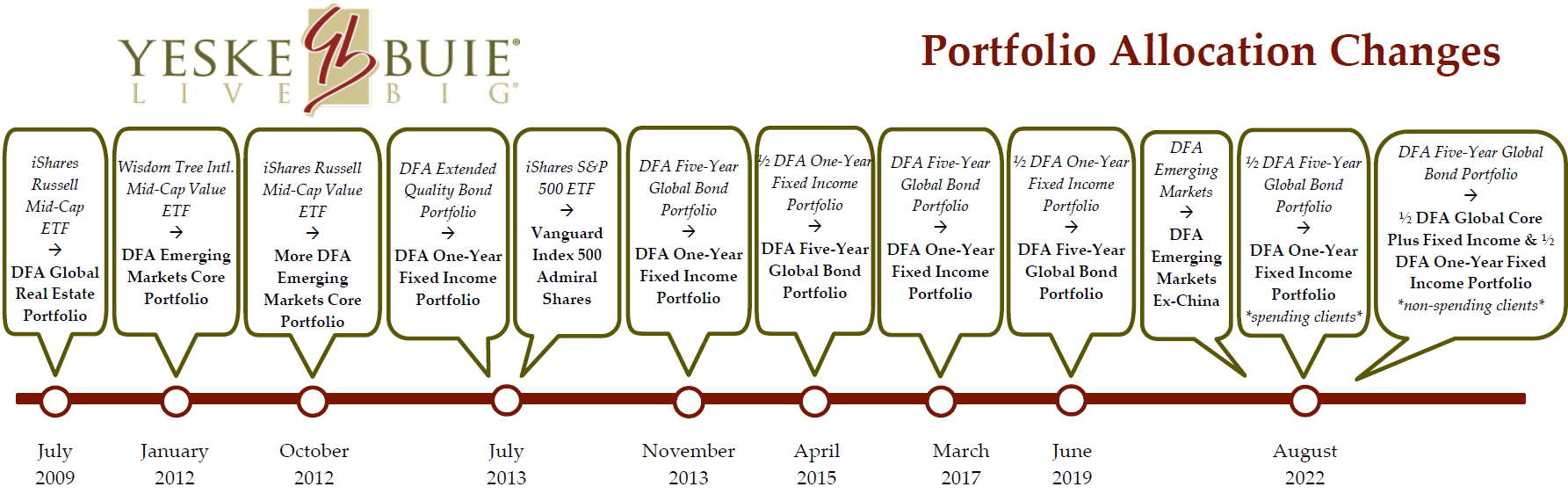

An Investment Approach That’s Stable, Not Static

From an outside perspective, it can be easy to label Yeske Buie’s investment philosophy as “passive.” However, while that descriptor is partly true (i.e. we do not churn the holdings of our Clients’ accounts or turn our approach upside-down based on the latest industry trends or fads), our approach to monitoring the components of our portfolios is anything but. We are constantly evaluating the shifting landscape of the global economy and looking for ways to capitalize on structural shifts in the market; just as is the case with our approach to rebalancing accounts, we “look” more frequently than we take action. With that being said, we’d like to provide a brief summary of the shifts we’ve made to our portfolios over the last few years to position our Clients’ investments to best harness the market’s movements for growth.

August 2022

- Allocation Change: Replaced DFA Emerging Markets Core Equity Portfolio with DFA Emerging Markets ex China Core Equity Portfolio

- Because we strive to be grounded and evidence-based in everything we do, we have found ourselves dissatisfied with the availability of reliable and transparent information being reported from the Chinese government as it relates to activity in its economy and financial markets. Given that reality, and now that we have a substitute available that enables us to continue to gain exposure to Emerging Markets without including Chinese companies, we believe the present moment provides an opportunity to make a shift that is in alignment with our core values.

- Allocation Change [for Clients who are regularly spending from their portfolios]: Replaced half of the bond portfolio (previously solely comprised of DFA Five-Year Global Bond Portfolio) with DFA One-Year Fixed Income Portfolio

- Given the opportunities presented by the current economic landscape, we elected to make this change to layer in a bit more resilience to our spending Clients’ Stable Reserve (the balance of the portfolio in cash and bonds), while still positioning half of this segment of the portfolio towards growth.

- Allocation Change [for Clients who are accumulating assets or not yet spending from their portfolios]: Reconstructed the bond portfolio (previously solely comprised of DFA Five-Year Global Bond Portfolio) by splitting it evenly between DFA Global Core Plus Fixed Income Portfolio and DFA One-Year Fixed Income Portfolio

- Likewise, given the current economic environment, we elected to build in a bit more growth potential to these Clients’ bond portfolio while still positioning half of this part of the portfolio as “dry powder” that will be available for liquidity and rebalancing needs.

June 2019

- Allocation Change: Replaced DFA One-Year Fixed Income Portfolio with DFA Five-Year Global Bond Portfolio and Schwab Value Advantage Money Market Fund

- As expected, the Federal Reserve increased rates consistently over the course of 2017 and 2018. Recent guidance indicates rates will remain flat for the remainder of the year. Meanwhile, after peaking at 2.8% a year ago, inflation has hovered around 2% for the past twelve months and appears to have stabilized. These factors indicate that a shift to a longer average maturity in our bond portfolio makes sense at this time and, as such, we replaced the one-year bond fund with the five-year fund. To mitigate the interest rate risk that comes with bonds with longer maturities, we also adjusted our fixed-income portfolio to include a money-market fund, which is currently yielding 2.27%

- More Information: Portfolio Update: Going Long On Bonds

March 2017

- Allocation Change: Replaced DFA Five-Year Global Bond Portfolio with DFA One-Year Fixed Income Portfolio

- As a consequence of economic and policy trends, we shifted our bond portfolios to a more conservative stance. Guidance in early 2017 made it clear that the Federal Reserve was committed to slowly, but consistently, stepping up the pace of interest rate increases going forward. This, combined with a modest but notable uptick in inflation, led us to conclude that the economic environment will be biased toward steadily rising interest rates for the first time since the Great Recession.

April 2015

- Allocation Change: Replaced half of the exposure to the DFA One-Year Fixed Income Portfolio with DFA Five-Year Global Fixed Income Portfolio

- While it appeared interest rates had nowhere to go but up at the end of 2013, over the next 18 months they remained virtually flat. News reports in the first half of 2015 continue to suggest that the outlook for rising rates is mild; as such, we determined there was more to be gained by diversifying our bond portfolios globally and added the Five-Year Global Fixed Income fund back into the mix.

- More Information: Portfolio Update: Toward a Better Bond Balance

November 2013

- Allocation Change: Replaced DFA Five-Year Global Bond Portfolio with DFA One-Year Fixed Income Portfolio

- To continue to lower the average maturity of the bonds in our Clients’ accounts, we shifted our bond portfolios to be singularly invested in the high-quality, short-term duration One-Year Fixed Income fund, further lowering the exposure to interest-rate risk in anticipation of rising interest rates.

- More Information: Investment Update – Going Short (Really Short!)

July 2013

- Allocation Change: Replaced DFA Extended Quality Bond Portfolio with DFA One-Year Fixed Income Portfolio and Removed iShares S&P 500 ETF, replaced with Vanguard 500 Admiral Shares

- There were two factors in play regarding the above shifts: regarding the update to our bond allocation – we eliminated the DFA Extended Quality Bond Portfolio from our Clients’ accounts to keep the average maturity low and the credit quality high in anticipation of rising interest rates; we also replaced the last remaining ETF in our portfolios with a low-cost Vanguard fund that achieved the same exposure, allowing us to rebalance accounts more efficiently.

- More Information: Investment Updates: A Little Fine Tuning

October 2012

- Allocation Change: Replaced iShares Russell Mid-Cap Value ETF with DFA Emerging Markets Core Portfolio

- This represented the second phase of the shift to complete the addition of a fund to achieve specific exposure to the Emerging Markets segment of the global economy.

- More Information: Portfolio Strategy Update: Toward a Truly Global Portfolio

January 2012

- Allocation Change: Replaced Wisdom Tree Int’l Mid-Cap ETF with DFA Emerging Markets Core Portfolio

- By early 2012, the segment of the global economy comprised of Emerging Markets (often referred to as the “BRIC” nations – Brazil, Russia, India and China, as well as several others) had grown to 12% of the world’s market capitalization. To continue to provide a globally diversified portfolio for our Clients, we began the first installment of a two-phase shift to achieve an exposure that more closely matched that of the world.

- More Information: The Case for Emerging Markets

July 2009

- Allocation Change: Replaced iShares Russell Mid-Cap ETF with DFA Global Real Estate Portfolio

- Just four months after the market bottomed out in the wake of the Great Recession, we added DFA’s Global Real Estate fund to our portfolios to capture a segment of the market that was priced for higher returns in the future. This presented a textbook opportunity to “buy low.”

- More Information: WSJ: A Return to Real Estate

As evidenced by the changes we’ve made over the last few years, we are diligent in our research and disciplined in our approach to making changes to our portfolios. We adjust our portfolios as necessary to maintain a mix of investments that best positions our Clients’ assets to harness the market’s movements for growth.