Articles of Interest

Grounded Investing

“Let’s Talk About the Big Book”

What is Wealth: The Size of Your Life or the Size of Your Wallet?

The Best of 2015

As we prepare this edition of the Digest, we’re hoping that you had a great end to 2015 and celebrate the start to 2016 with your close family and friends. The end of one year and the beginning of another is a great time to…

Expert Spotlight: Dr. Jim McCabe on Authentic Conversations

I had a meeting last week with a client for some ongoing eldercare planning for her parents. In the middle of our discussion, she mused aloud that she could not recall when the conversation had changed. “As long as I can remember, my conversations with…

The Best of 2014

As we prepare this edition of the Digest, we’re hoping that you had a great end to 2014 and celebrated the start to 2015 with your close family and friends.The end of one year and the beginning of another is a great time to reflect….

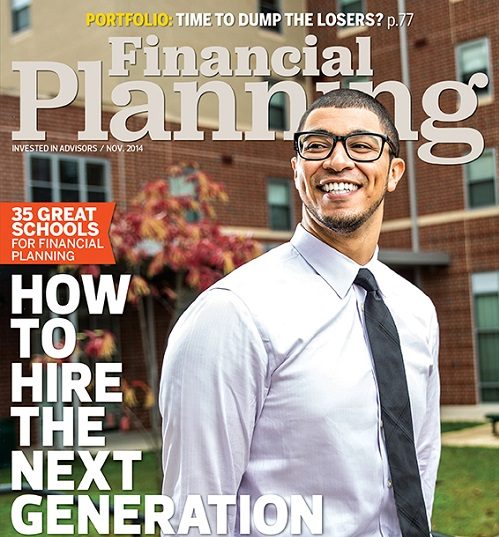

How to Hire the Next Generation

The November issue of Financial Planning Magazine sports the smiling face of our very own Yusuf Abugideiri under the heading, How to Hire the Next Generation. Elissa is quoted extensively in the accompanying article, beginning with a discussion of how Yeske Buie has helped support…

The YouToons Get Ready for Obamacare

The Kaiser Family Foundation has created an animation series known as the “YouToons” to make learning about the healthcare law a much more easy-to-follow and enjoyable process. The following video is well worth the seven minutes to get the basics on Obamacare. We recently wrote…

Your Email Inbox: The Weakest Link?

Advancements in technology have revolutionized how we live and communicate, with few technologies dominating more of our daily life than email. The convenience and ubiquity of email, however, has a dark side: as more of our personal and financial information finds its way to our email…

Contact Info

Washington, D.C. Metro Area

Vienna, VA 22180

San Francisco Bay Area

San Francisco, CA 94104